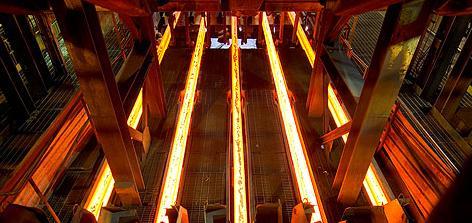

China steel now as cheap as cabbage,weighing on global price

As global steel prices face downward pressure from falling demand, the situation in China is making the problem all the more intractable, as overcapacity is prompting Chinese steel enterprises to cut their prices in order to boost exports.

Data from the China Iron & Steel Association (CISA) showed Monday that domestic steel prices have been falling for 12 straight weeks, with the Steel Composite Price Index down more than 13% compared since the end of last year, even as the nation’s construction activity and real-estate market are cooling significantly.

The average price for the range of steel products on offer has fallen to 3,212 yuan ($520) per metric ton for the first half of the year, down 28% from the average price in 2012, CISA data showed.

And as a People’s Daily report said Monday, the price level means the steel is now almost as cheap by weight as Chinese cabbage.

“Sharply slowing steel demand growth in an oversupplied sector is the key reason for China’s currently low steel prices,” CIMB analysts said in a recent note.

Standard & Poor’s also cited Chinese oversupply as the largest headache for steel makers in the rest of Asia, and is likely to remain so.

A recent survey by CISA said the steel-billet inventory of key enterprises was up 36% in July, compared to a year earlier, steel-product inventory climbed 21.3%.

Pressures arising from expanding inventories and sluggish domestic demand have made for cut-throat competition among China’s steel mills, resulting in meager profits. The margin for China’s large and medium-sized steel companies was 0.54% for the first seven months of 2014, CISA said.

And the problems are affecting the global markets too, as the Chinese firms cut prices to try to boost exports so as to make up for the weak domestic sales.

Customs data released Monday showed China’s net exports of steel product reached a record 7.2 million metric tons in September, up 4.5% from the last all-time high, posted in May, according to The Wall Street Journal.

That’s bad news for the exporters, as many of them are suffering from the price-for-volume strategy.

The average price for exported steel products was only $793 per metric ton in the first half of this year, down 9% from a year ago, with companies breaking even at that level, getting benefit only from associated tax breaks for exporters, CISA said.

Meanwhile, due to overcapacity, steel prices in both China and Europe have fallen more than 10% so far this year, while the price of iron ore — the key component for smelting steel — touched a five-year low in September, a Bloomberg report said earlier last week.

In a forecast issued last week, the World Steel Association said global steel consumption would likely post a slower pace in 2014 as a whole, with “weaker performance in the emerging and developing economies.”

Among the main contributing factors to the downbeat forecast, the association said, was China’s structural shift to its economy and the cooling-down of its property market.

XINSTEEL INFORMATION

+86 371 55057610

+86 371 55057610  inquiry@xsteelplate.com

inquiry@xsteelplate.com

Tel:+86 371 55057610

Tel:+86 371 55057610  Fax: +86 371 5505 7611

Fax: +86 371 5505 7611